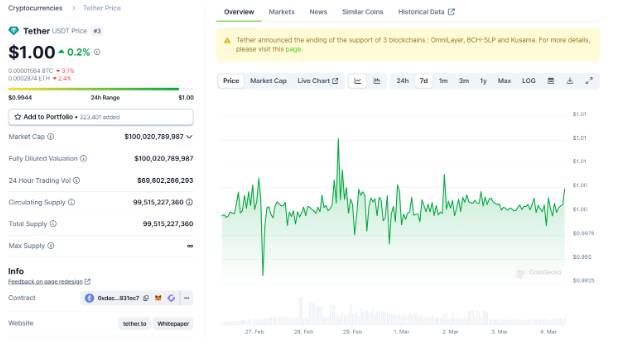

The market value of Tether’s USDT stablecoin reaches a record $100 billion.

Tether has reached a record market value of $100 billion, making it the biggest stablecoin by market capitalization even more.

Stablecoin for cryptocurrency Tether’s market valuation has surpassed $100 billion, marking an all-time record. The company has grown by 9% so far this year, closing the gap with its next-biggest competitor, USD Coin.

According to statistics from CoinGecko, USDT briefly reached the $100 billion milestone on March 4. The market capitalization of the cryptocurrency varies depending on the price and supply that are in circulation.

In terms of market capitalization, it is more than $71 billion more than its next competitor stablecoin, USDC, which is distributed by Circle and has also shown growth in value this year.

However, other data sources like CoinMarketCap show that Tether has not yet passed the $100 billion mark.

Tether’s market capitalization positions it slightly above the e-commerce behemoth Shopify and on par with the British oil and gas tycoon BP.

According to its website, Tether is a cryptocurrency that is based on the value of the US dollar and is accessible on 14 different blockchains and protocols.

After Ether, it is now the third-largest cryptocurrency by market capitalization. It has developed into a significant blockchain-based alternative for cryptocurrency traders in need of a reliable asset.

The cryptocurrency industry has rebounded over the last month, reaching a market capitalization of over $2 trillion, with Bitcoin seeing a 50% price gain and reaching two-year highs.

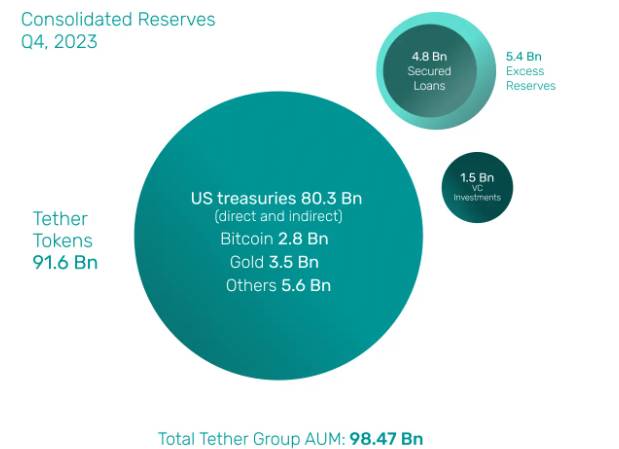

The token’s issuing business, Tether, asserts that it can back each USDT token 1:1 with its independently audited reserves, which are mostly comprised of yield-bearing U.S. Treasury Bills (T-Bills), which are short-term loans made to the federal government of the United States.

The firm reported a record quarterly profit of $2.85 billion for the fourth quarter of 2023, with $1 billion coming from its T-Bills. Its $80 billion worth of T-Bill holdings were revealed in its fourth-quarter report, and it has previously declared itself to be among the biggest global purchasers of US government debt.

In the cryptocurrency world, there has been debate over the quality of the assets supporting USDT. Tether has attempted to lower its exposure to some assets that are seen to carry a greater risk.

Tether promised in late 2022 that it will cease lending money out of its reserves by the end of 2023.

These intentions never came to pass; as of the end of 2023, Tether had $4.8 billion in loans outstanding, however that amount had decreased by almost $1 billion from the beginning of the year. It pledged to reduce the loans to zero in 2024 and asserts that they are completely collateralized.

The Tron blockchain, which according to a January United Nations assessment “has become a preferred choice” for money laundering and cyber crime headquartered in Southeast Asia, is home to more than half of the USDT that is now in circulation.

Tether has retaliated against the findings, stating that the UN neglected to highlight the company’s cooperation with law enforcement and the traceability of the token.